Starting with Stock Market Basics, this guide will take you on a journey through the fundamental concepts of investing, offering insights that can shape your financial future.

Exploring the ins and outs of the stock market, this overview will equip you with the knowledge needed to navigate the world of investments with confidence.

Importance of Understanding Stock Market Basics

Understanding the basics of the stock market is crucial for investors looking to navigate the complex world of investing. It provides a foundation that enables individuals to make informed decisions and mitigate risks associated with trading stocks.

Knowledge for Informed Investment Decisions

Having a grasp of stock market basics allows investors to analyze market trends, evaluate company performance, and assess potential risks before making investment decisions. This knowledge empowers individuals to make informed choices that align with their financial goals and risk tolerance.

Risks of Investing Without Understanding Basics

Investing in the stock market without understanding the fundamentals can lead to costly mistakes and financial losses. Without proper knowledge, investors may fall prey to market volatility, make impulsive decisions, or fail to diversify their portfolios effectively. Understanding stock market basics is essential to avoid these pitfalls and safeguard investments.

Key Concepts in Stock Market Basics

Stock market basics involve understanding key terms and concepts that drive the financial markets. Let’s delve into some of the fundamental concepts that every investor should be familiar with.

Stocks, Bonds, Mutual Funds, and ETFs

- Stocks: Represent ownership in a company and provide investors with a share of the company’s profits.

- Bonds: Debt securities issued by governments or corporations, where investors lend money in exchange for periodic interest payments and the return of the principal amount at maturity.

- Mutual Funds: Pooled funds collected from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by a professional fund manager.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but trade on stock exchanges like individual stocks, offering diversification and liquidity.

Market Indices: S&P 500 and Dow Jones Industrial Average, Stock Market Basics

Market indices like the S&P 500 and Dow Jones Industrial Average serve as benchmarks to measure the performance of the overall stock market. They track the prices of a specific group of stocks, providing insights into market trends and investor sentiment.

Dividends and Capital Gains

- Dividends: Payments made by a company to its shareholders from its profits as a reward for holding its stock. They can provide a steady income stream for investors.

- Capital Gains: Profits realized from selling an investment at a higher price than the purchase price. They are a key component of total returns in stock market investments.

How Stock Market Works: Stock Market Basics

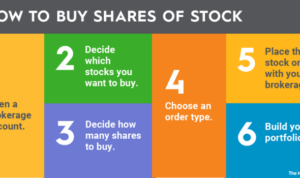

Understanding how the stock market works is essential for anyone looking to invest. Let’s delve into the process of buying and selling stocks, how supply and demand impact stock prices, and the important role of brokers and stock exchanges in facilitating transactions.

Buying and Selling Stocks

When buying stocks, investors purchase shares of a company through a brokerage account. These shares represent ownership in the company and can be bought and sold on the stock market. Selling stocks involves placing a sell order through a broker, who then executes the trade on the investor’s behalf.

Supply and Demand Impact

- Stock prices are influenced by the basic economic forces of supply and demand. If there is high demand for a particular stock but limited supply, the price tends to rise. Conversely, if there is more supply than demand, the price may decrease.

Market dynamics are driven by investor sentiment, company performance, economic indicators, and global events.

Role of Brokers and Stock Exchanges

- Brokers act as intermediaries between buyers and sellers in the stock market. They execute trades on behalf of investors and provide valuable insights and advice.

- Stock exchanges are platforms where buyers and sellers come together to trade stocks. They ensure transparency, liquidity, and efficiency in the market by matching buy and sell orders.

Common Investment Strategies for Beginners

Investing in the stock market can be intimidating for beginners, but understanding some common investment strategies can help you navigate the market with confidence.

Long-Term Investing and Its Benefits

Long-term investing involves holding onto investments for an extended period, typically five years or more. This strategy allows you to ride out market fluctuations and benefit from the power of compounding returns over time. By investing for the long term, you can potentially grow your wealth steadily and minimize the impact of short-term volatility.

Diversification and Its Importance in Reducing Risk

Diversification is the practice of spreading your investments across different asset classes, industries, and geographic regions to reduce risk. By diversifying your portfolio, you can help protect yourself from the negative impact of a downturn in any single investment. This strategy can help you achieve a more stable and balanced return over time.

Active vs. Passive Investing

Active investing involves actively buying and selling investments in an attempt to outperform the market. This approach requires in-depth research, analysis, and monitoring of investments. On the other hand, passive investing involves investing in index funds or exchange-traded funds (ETFs) that track the performance of a specific market index. Passive investors aim to match the market return rather than beat it.

Both strategies have their own advantages and drawbacks, so it’s important to consider your investment goals and risk tolerance when choosing between active and passive investing.

Resources for Learning Stock Market Basics

Investing in your knowledge of the stock market can set you up for success in the long run. Here are some reputable sources to help beginners get started:

1. Books

- “The Intelligent Investor” by Benjamin Graham – A classic book that emphasizes the importance of value investing and fundamental analysis.

- “A Random Walk Down Wall Street” by Burton Malkiel – This book covers various investment strategies and provides insights into the behavior of stock markets.

2. Websites

- Investopedia – A comprehensive online resource that offers tutorials, articles, and a stock market simulator to practice trading.

- CNBC – Stay updated with the latest financial news, market trends, and expert analysis to make informed investment decisions.

3. Courses

- Coursera – Platforms like Coursera offer online courses on stock market basics, investment strategies, and financial analysis.

- Udemy – Explore a wide range of courses taught by industry professionals to deepen your understanding of the stock market.

Importance of Staying Updated with Financial News and Market Trends

Keeping tabs on financial news and market trends is crucial for making informed investment decisions. By staying informed, you can identify potential opportunities, understand market fluctuations, and adjust your investment strategy accordingly. Remember, knowledge is power in the world of investing.

How Virtual Trading Platforms Can Help Beginners

Virtual trading platforms allow beginners to practice investing without risking real money. These platforms simulate real market conditions, enabling users to buy and sell stocks, track their performance, and experiment with different strategies. It’s a safe way to gain hands-on experience and build confidence before diving into actual trading.