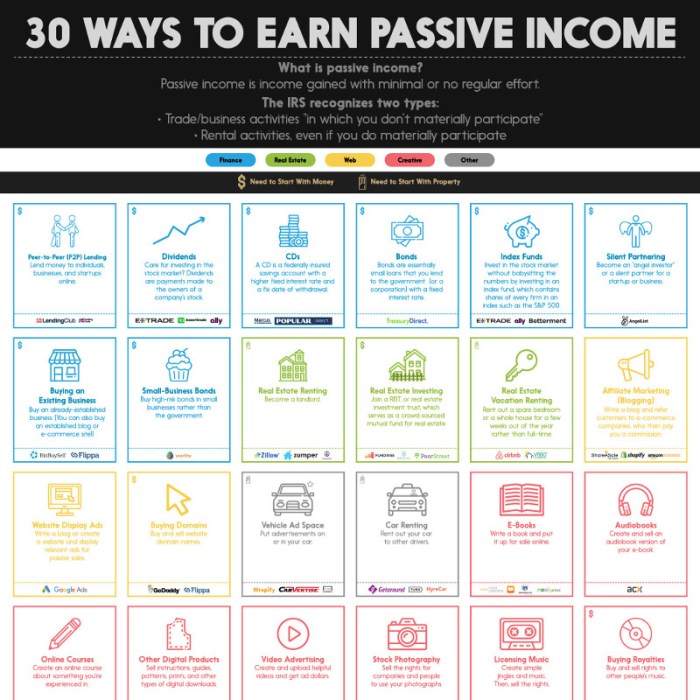

Passive Income Ideas are all the rage right now, offering a variety of ways to make money while you sleep. From real estate to online businesses, this overview will dive into the world of generating income without breaking a sweat.

Passive Income Ideas

Looking to make money while you sleep? Here are some popular passive income ideas that can help you achieve financial freedom:

1. Real Estate Investments

Investing in rental properties can generate a steady stream of passive income through rental payments. Plus, properties can appreciate over time, increasing your wealth.

2. Dividend Stocks

By investing in dividend-paying stocks, you can earn regular income without having to actively trade. Companies pay out a portion of their profits to shareholders, providing a source of passive income.

3. Creating an Online Course

Once you create and market an online course, you can earn passive income every time someone enrolls. It takes effort upfront, but can provide long-term returns.

4. Peer-to-Peer Lending

Platforms like Lending Club allow you to lend money to individuals or businesses and earn interest on the loans. It’s a hands-off way to generate passive income.

5. Affiliate Marketing

By promoting products or services through affiliate links on your blog or social media, you can earn a commission on sales made through your referral. It’s a great way to monetize your online presence.

Having multiple passive income streams offers several benefits, including diversification of income sources, reducing dependency on a single source, and increasing overall cash flow. This can provide financial stability and help you achieve financial independence by creating a reliable income stream that continues to grow over time.

Real Estate Investments

Investing in real estate can be a lucrative way to generate passive income. There are various opportunities in the real estate market that can provide a steady stream of income without requiring active involvement on a daily basis.

Examples of Passive Income Opportunities in Real Estate

- Rental Properties: Owning rental properties and collecting monthly rent payments from tenants.

- Real Estate Investment Trusts (REITs): Investing in publicly traded companies that own, operate, or finance income-generating real estate.

- Real Estate Crowdfunding: Pooling money with other investors to invest in real estate projects through online platforms.

Pros and Cons of Investing in Rental Properties

- Pros:

- Steady Income: Rental properties can provide a consistent source of monthly income.

- Property Appreciation: Real estate values tend to increase over time, potentially leading to capital gains.

- Tax Benefits: Investors can take advantage of tax deductions on mortgage interest and property expenses.

- Cons:

- Property Management: Dealing with tenants, maintenance issues, and property upkeep can be time-consuming.

- Market Risk: Real estate values can fluctuate based on market conditions, impacting the overall return on investment.

- Liquidity Issues: Real estate is not a liquid asset, meaning it can take time to sell a property and access funds.

How to Generate Passive Income Through Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their resources and invest in a diverse range of real estate projects. By participating in crowdfunding campaigns, individuals can access opportunities that may have been out of reach due to high capital requirements. Investors can earn passive income through rental returns, property appreciation, and other income streams generated by the underlying real estate assets.

Online Business Ventures

Looking to generate passive income through online businesses? Here are some ideas to get you started!

Affiliate Marketing

Affiliate marketing is a popular way to earn passive income by promoting products or services and earning a commission for each sale made through your referral link.

- Join affiliate programs of companies in your niche.

- Create valuable content to drive traffic to your affiliate links.

- Optimize your website for conversions to increase your earnings.

Dropshipping

Dropshipping is a business model where you sell products to customers without holding any inventory. Here’s how you can make passive income with dropshipping:

- Set up an online store on platforms like Shopify or WooCommerce.

- Find reliable suppliers who will fulfill orders on your behalf.

- Focus on marketing and customer service while your suppliers handle shipping and inventory.

Stock Market Investments

Investing in the stock market can be a great way to generate passive income. One popular strategy is to focus on dividend-paying stocks, which provide regular payouts to investors.

Dividend-paying Stocks

- Dividend-paying stocks are shares of companies that distribute a portion of their profits to shareholders on a regular basis.

- Investors can benefit from both the appreciation of the stock price and the passive income generated from dividends.

- Some companies have a long history of increasing their dividends, making them attractive options for passive income seekers.

Index Funds, Passive Income Ideas

Index funds are another popular option for passive income investors. These funds track a specific market index, such as the S&P 500, and provide diversification and low fees.

- Investing in index funds can provide steady returns over time without the need for active management.

- They offer exposure to a broad range of companies, reducing the risk associated with individual stock picking.

- Index funds are ideal for beginners looking to start investing in the stock market for passive income due to their simplicity and low cost.

Tips for Beginners

- Start by educating yourself about the basics of investing and the stock market.

- Consider starting with a small amount of money and gradually increasing your investments as you gain confidence.

- Diversify your portfolio to reduce risk and consider consulting with a financial advisor for personalized advice.

Peer-to-Peer Lending: Passive Income Ideas

Peer-to-peer lending is a popular method of generating passive income where individuals lend money to other individuals or businesses through online platforms, cutting out traditional financial institutions.

How Peer-to-Peer Lending Works

- Investors sign up on peer-to-peer lending platforms and choose borrowers to lend money to.

- Borrowers request loans for various purposes, and investors can fund a portion or the full amount of the loan.

- Investors earn returns through interest payments made by borrowers over time.

Risks in Peer-to-Peer Lending

- Default Risk: Borrowers may fail to repay the loan, leading to loss of principal for investors.

- Liquidity Risk: Funds may be tied up for the duration of the loan term, limiting access to cash when needed.

- Platform Risk: The platform itself may face financial difficulties or go out of business, impacting investors’ returns.

Tips for Maximizing Returns and Minimizing Risks

- Diversify: Spread your investments across multiple loans to reduce the impact of defaults.

- Research: Thoroughly evaluate borrower profiles, loan purposes, and platform track records before investing.

- Reinvest Earnings: Reinvesting returns can compound your earnings over time, increasing overall profitability.