Understanding Lifetime Customer Value sets the stage for unlocking the secrets to long-term customer relationships and business profitability. Dive into the world of LCV and discover how it can revolutionize your approach to customer retention and growth.

Introduction to Lifetime Customer Value

Lifetime Customer Value (LCV) is the total revenue a business can expect from a customer throughout their entire relationship. It takes into account not just the initial purchase but also the repeat purchases and referrals that a customer can bring over time.

Understanding LCV is crucial for businesses because it helps them make informed decisions about customer acquisition, retention, and overall marketing strategies. By knowing the value that each customer can bring over their lifetime, businesses can allocate resources more effectively and focus on building long-term relationships.

Impact of LCV on Business Decisions, Understanding Lifetime Customer Value

- Allocating marketing budget: By knowing the LCV of customers, businesses can determine how much to invest in acquiring new customers versus retaining existing ones.

- Customer segmentation: LCV helps businesses identify high-value customers and tailor marketing strategies to maximize their value.

- Product development: Understanding LCV can guide businesses in creating products or services that cater to the needs and preferences of their most valuable customers.

Calculating Lifetime Customer Value

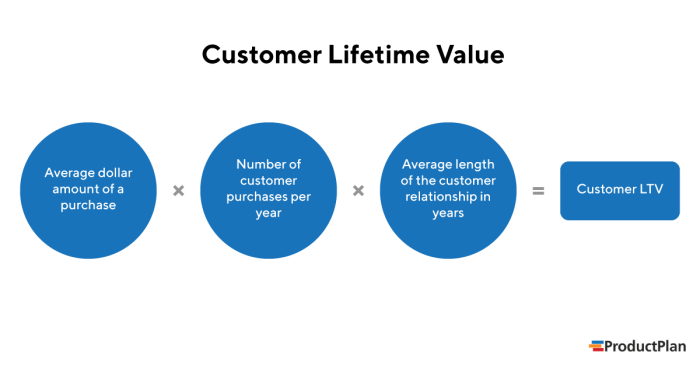

In order to determine the Lifetime Customer Value (LCV) of a customer, a specific formula is commonly used. This formula helps businesses understand the total value that a customer brings over the entire duration of their relationship with the company.

The Formula for Calculating LCV

LTV = (Average Value of a Sale) x (Number of Repeat Transactions) x (Average Retention Time)

The formula for calculating Lifetime Customer Value involves multiplying the average value of a sale by the number of repeat transactions and then by the average retention time of a customer.

Variables in LCV Calculations

- The Average Value of a Sale: This refers to the average amount of money a customer spends on each transaction with the company.

- Number of Repeat Transactions: This indicates how often a customer makes purchases or engages with the company over time.

- Average Retention Time: This represents the average duration a customer stays loyal to the company before churning.

Step-by-Step Guide to Calculate LCV for a Customer

- Determine the Average Value of a Sale by dividing the total revenue by the number of transactions over a specified period.

- Calculate the Number of Repeat Transactions by analyzing the purchase history of the customer to see how often they return.

- Find the Average Retention Time by calculating the average duration between a customer’s first and last purchase.

- Plug these values into the LCV formula: LCV = (Average Value of a Sale) x (Number of Repeat Transactions) x (Average Retention Time).

- Once you have calculated the LCV for a customer, you can use this information to make informed decisions about marketing strategies, customer retention efforts, and overall business growth.

Factors Influencing Lifetime Customer Value: Understanding Lifetime Customer Value

The lifetime value of a customer is influenced by various factors that impact their behavior, retention, and purchase frequency. Understanding these key factors is essential for businesses to accurately calculate and maximize their LCV.

Customer Behavior

Customer behavior plays a significant role in determining their lifetime value. Factors such as buying patterns, preferences, and loyalty to a brand can greatly impact how much a customer spends over their lifetime. Businesses need to analyze and understand customer behavior to tailor their marketing strategies and offerings effectively.

Retention

Customer retention is crucial for increasing lifetime customer value. Retaining existing customers is more cost-effective than acquiring new ones, and loyal customers tend to spend more over time. By focusing on retention strategies such as personalized communication, loyalty programs, and exceptional customer service, businesses can enhance their LCV significantly.

Purchase Frequency

The frequency at which customers make purchases also influences their lifetime value. Customers who make frequent purchases are likely to contribute more to a business’s revenue over time. Encouraging repeat purchases through targeted promotions, cross-selling, and upselling can boost the overall lifetime value of customers.

Customer Segmentation

Customer segmentation is another crucial factor that can impact LCV calculations. By categorizing customers based on demographics, behavior, and preferences, businesses can tailor their marketing efforts and offerings to specific customer segments. This targeted approach can help increase customer engagement, retention, and ultimately, lifetime value.

Strategies to Improve Lifetime Customer Value

Increasing Lifetime Customer Value (LCV) is crucial for businesses looking to maximize revenue and build long-term relationships with customers. By implementing effective strategies, companies can enhance customer loyalty and encourage repeat purchases, ultimately boosting overall profitability.

Utilize Customer Loyalty Programs

Customer loyalty programs are a powerful tool for increasing LCV as they incentivize customers to continue purchasing from a specific brand. By offering rewards, discounts, or exclusive offers to loyal customers, businesses can foster a sense of appreciation and encourage repeat business.

- Implement a points-based system where customers earn rewards for each purchase.

- Offer exclusive perks such as early access to sales or special events.

- Create personalized offers based on customer preferences and past purchases.

Enhance Customer Experience

Improving the overall customer experience can significantly impact LCV by establishing a positive relationship with customers and increasing satisfaction levels. By providing exceptional service, personalized interactions, and seamless transactions, businesses can build trust and loyalty among their customer base.

“Customer experience is the new marketing battleground.”

Steve Cannon

Implement Cross-Selling and Upselling Techniques

By cross-selling related products or upselling higher-value items, businesses can increase the average purchase amount per customer and maximize revenue potential. These techniques not only boost immediate sales but also contribute to long-term LCV by offering customers additional value and solutions to their needs.

- Suggest complementary products during the checkout process.

- Showcase premium options or bundles to encourage upsells.

- Personalize recommendations based on customer behavior and preferences.

Provide Excellent Customer Service

Delivering exceptional customer service is essential for maintaining customer satisfaction and loyalty, ultimately leading to higher LCV. By resolving issues promptly, listening to feedback, and going above and beyond to meet customer needs, businesses can build strong relationships and earn repeat business.

“It takes months to find a customer… seconds to lose one.”

Vince Lombardi

Importance of Customer Lifetime Value in Marketing

Customer Lifetime Value (CLV) is a crucial metric for businesses to understand as it can shape their marketing strategies and overall approach to customer management. By calculating the CLV, companies can determine the value of each customer over their entire relationship with the business, allowing for more targeted and effective marketing efforts.

Role of LCV in Customer Acquisition and Retention

- CLV helps businesses identify high-value customers and focus their acquisition efforts on attracting similar customers.

- It also plays a key role in customer retention strategies by highlighting the importance of building long-term relationships with customers to maximize their lifetime value.

- Understanding the CLV of customers allows businesses to allocate resources wisely, investing more in retaining valuable customers while also identifying those with lower potential for long-term value.

Tailoring Marketing Efforts based on LCV Insights

- Businesses can personalize their marketing messages and offers based on the CLV of different customer segments, ensuring that efforts are tailored to maximize the value derived from each customer.

- CLV insights can also inform product development and pricing strategies, helping companies create offerings that resonate with high-value customers and encourage repeat purchases.

- By leveraging CLV data, businesses can optimize their marketing spend, focusing on channels and tactics that are most effective in driving long-term customer value and loyalty.

Case Studies and Examples

In the world of business, understanding Lifetime Customer Value (LCV) can make a significant impact on a company’s success. Let’s delve into real-life case studies to see how businesses have leveraged LCV effectively to make informed decisions and drive growth.

Amazon

Amazon is a prime example of a company that has mastered the art of utilizing Lifetime Customer Value. By analyzing customer behavior, purchase patterns, and engagement metrics, Amazon has been able to tailor personalized recommendations, optimize its marketing strategies, and enhance the overall customer experience. This has led to increased customer loyalty, higher retention rates, and ultimately, greater profitability for the e-commerce giant.

Netflix

Another success story in understanding Lifetime Customer Value is Netflix. By utilizing data analytics to understand subscriber preferences, viewing habits, and churn rates, Netflix has been able to develop highly targeted content recommendations, personalized marketing campaigns, and subscription plans that cater to individual customer needs. This approach has not only helped Netflix attract new customers but also retain existing ones, leading to significant revenue growth over the years.

Starbucks

Starbucks is a prime example of a company that has effectively used LCV analysis to drive customer loyalty and increase lifetime value. By implementing a rewards program that incentivizes repeat purchases, personalized offers based on customer preferences, and targeted promotions, Starbucks has been able to create a loyal customer base that keeps coming back for more. This has not only boosted sales but also enhanced the overall customer experience, leading to a strong competitive advantage in the coffee industry.